Rout in the Markets: What Happened? And What to Do Now ...

Manage episode 432982859 series 3586928

IMPORTANT: somebody has been impersonating me on here and asking readers to message them on WhatsApp. Obviously it is not me. Don’t engage. Stop engaging and block, if you have started. And DON’T send any money.

I am now at the Edinburgh Fringe with Shaping the Earth, a “lecture with funny bits” about the history of mining. The show is going great guns. I’m then taking it to London on October 9th and 10th to the Museum of Comedy. Please come if you fancy a bit of “learning and laughter”. The Edinburgh link is here. And the London link is here.

But today, just as the title suggests, I am going to explain the extraordinary volatility we have seen in markets all over the world this week. I’ll then look at what we should be doing next. What should we do with our gold/bitcoin/oil and gas/equities and all the rest of our holdings?

The trigger for all of this lies in the Land of the Rising Sun.

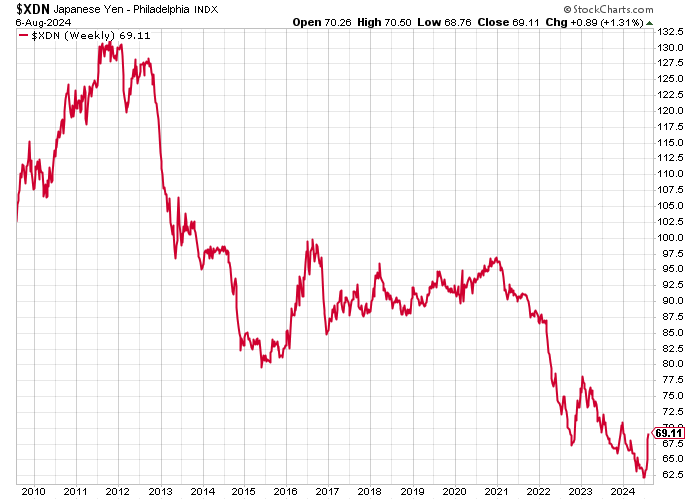

The Japanese yen has been undervalued for a long time. For the first time, perhaps in my living memory, Japan has become a cheap—well, not super expensive—country to visit. Against the dollar, pound, and euro, then yen was at multi-decade lows.

The main reason for the weak yen is Japanese monetary policy. The Japanese central bank has suppressed rates for many years in an effort to stimulate the Japanese economy. It hasn’t worked, but like so many policymakers, when confronted with a failed policy, the reaction is not to change tack but to double down. In 2016, rates actually went negative.

But even as the rest of the world raised rates to try and counter the inflation that came post-COVID, Japan kept them low, creating quite the differential.

Until last week, Japan had only raised rates once in 17 years—by 0.25% in March.

Here are 15 years of the yen against the US dollar so you can see just how weak the currency had got.

Talk about a long-term bear market.

This situation created what is known as the Yen Carry Trade. You borrow in yen, pay a very low rate of interest, and then use the money to buy other assets that pay a better yield. It might be other currencies, bonds, equities, or even cryptocurrencies.

Let’s say you borrow at below 1% and buy a government bond in another currency that yields 5%. The arbitrage is pretty generous, and the risk is very low. Borrow at below 1% and buy something like an S&P 500 tracker, which might grow by 10-15%, and the rewards are handsome.

The longer this situation has gone on, the more capital has gone into this trade, and the greater the risk taken on. Not unlike the British riots (too much immigration for too long when nobody voted for it), this has been a powder keg waiting to blow for a long time. All that was required was the spark.

18 эпизодов